Mortgage Rates in 2023: What the Betting Markets are Predicting

January 18, 2023

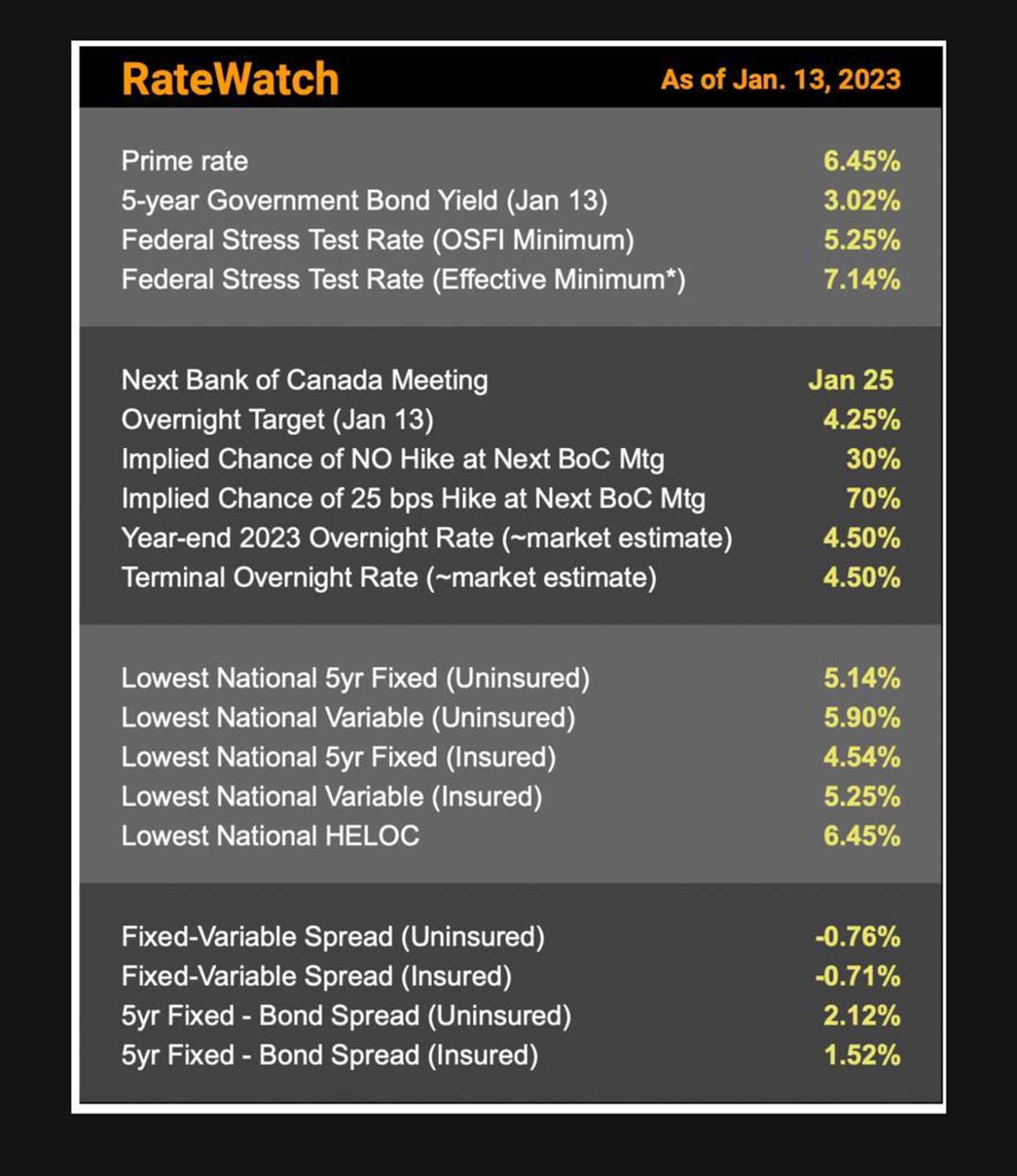

On Jan 25th, 2023, Bank of Canada will announce whether they will hike rates again. The derivatives markets are currently pricing in a 70% chance of a 25-bps (0.25%) rate increase. The conventional view is that, this will be the final rate hike.

While inflation appears to be slowing down, the major issue remains in grocery prices, which are up more than 11% year over year. The next major contributor to high inflation is actually the higher interest rate costs. Higher borrowing costs lead to higher rent prices.

When comparing rates, keep in mind there are differences between the bank of Canada's overnight rate (4.25%), prime rate (6.45%), fixed vs variable mortgage rates (5.14% / 5.9%), insured vs uninsured rates (4.89% vs 5.14%).

Currently the variable rate is higher than the fixed rate. That is inverted. In normal market conditions, variable rates are lower than the fixed rates. This implies that rates are expected to come down.

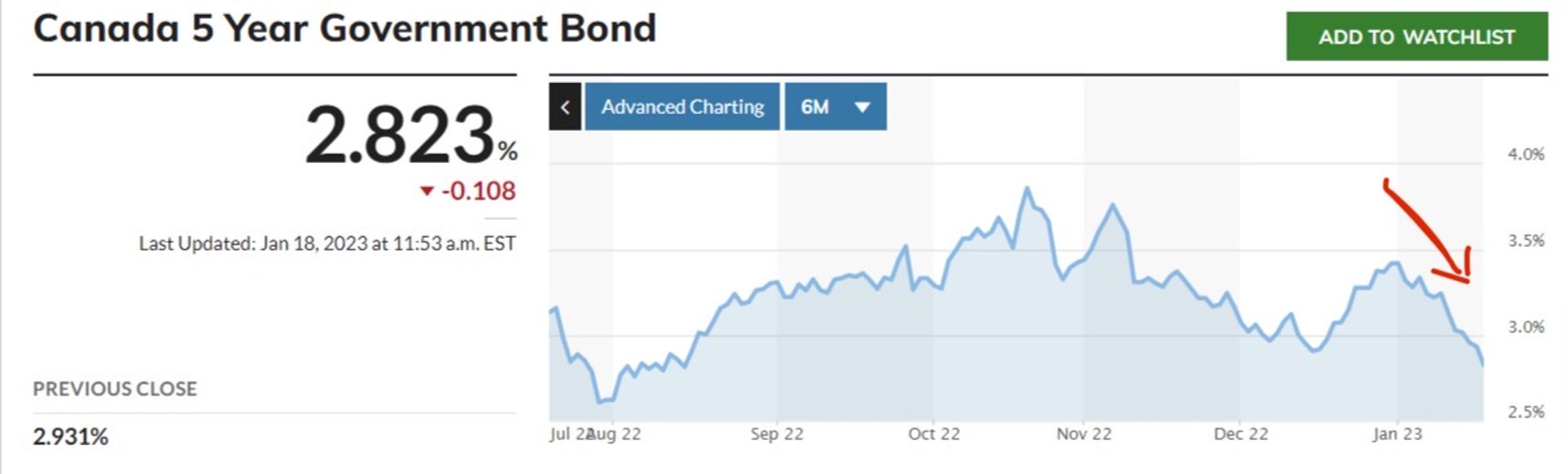

The 5 year fixed mortgage rates correlate to the Govt of Canada 5 yr bond yield. Which is down 0.6% since the beginning of the year. The 5 year fixed mortgage rates are also down. Before the new year, the best 5 year fixed uninsured rates were 5.79%, compared to the 5.14% today.

A continuation of this trend and slowing of inflation would be positive for home buyers that want to qualify for mortgages. Home buyers today are being stress tested at an effective rate of 7.14% to qualify for mortgages. See the chart below.

Whether you are thinking of buying, refinancing, or selling/ breaking your mortgage, we recommend scheduling a call with a knowledgeable mortgage broker.