Home Prices vs Mortgage Rates - Is this the most important factor in predicting home prices?

July 28, 2022

There has been much talk of interest rates recently and how it has led to a real estate slow-down. Do high interest rates really cause home prices to fall or is there something else at play? Let’s explore this question by looking at the Greater Toronto Area housing market.

In the beginning of the pandemic, we saw home prices increase as banks began reducing mortgage rates to historical lows. Now, as mortgage rates have risen quickly in recent months, prices have come back down. As interest rates go up, mortgage payments go up, and mortgage payments as a percentage of a buyer’s income dictates the amount of mortgage they qualify for. Therefore it makes sense that changes in mortgage rates have an inverse relationship to the price buyers can afford to pay for a home. Is predicting home prices as easy as looking at changes in mortgage rates?

Interest rates rise

Mortgage payments increase

Buyers qualify for lower mortgages

Buyers make lower priced offers

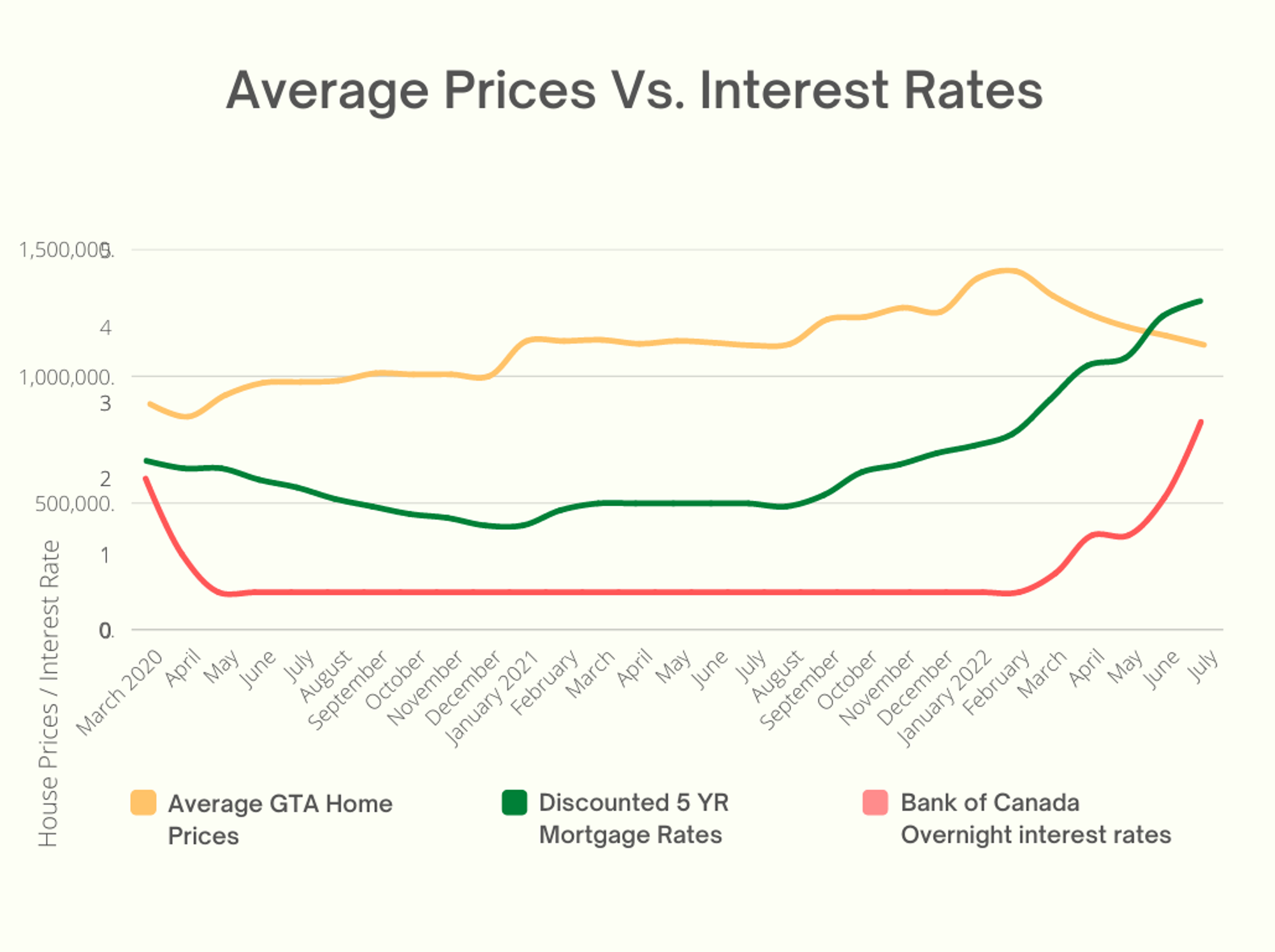

Here is a chart showing discounted mortgage rates, the Bank of Canada rate, and average GTA housing prices in the last 2 years.

Source: Interest rate source https://www.bankofcanada.ca/ & https://www.ratehub.ca/. Average price stats compiled from TRREB data.

If we see rates rise, we would expect to see the impact of reduced affordability showing up in home prices a few months later. Looking at the last 2 years, the correlation coefficient between percentage change in home prices and percentage change in mortgage rates, after accounting for a 2-month lag in home prices, is -35%. This isn’t a very strong correlation. In the graph above you’ll notice that while mortgage rates began increasing in August 2021, we saw strong price growth in housing through to February 2022.

Clearly there are other factors that can impact home prices, such as household savings (including capital inflow from immigrants), mortgage qualification rules (i.e. the stress test introduced in 2017), household wage growth, supply and demand of housing (i.e. lack of inventory due to Covid-19 lockdowns, lack of new home construction to meet population growth), among others.

While high interest rates and their common fluctuations themselves don’t have a strong correlation to prices, the rapid and significant increase in that rate can lead to a demand shock that will lead the market to fall out of equilibrium in the short term. Keeping an eye on mortgage rates is a great idea, but not enough to fully predict house prices. Ultimately, in the long run, more of the other supply/demand variables in the market will play a bigger role in determining where home prices are headed. The media may overemphasize the importance of rates, but for fast-growing housing markets with chronic supply shortages, you might be better off keeping an eye on this crucial stat to understand when the market is turning around.

You may also be interested in this article where we talk about why we think all signs point to higher home prices in the Greater Toronto Area in the long run.

TopHouse is one of the fastest-growing Home Search Apps with with a focus on speed and user friendliness, including short video walkthroughs that make homes easy to browse. We are constantly improving our platform to help home buyers and sellers make better decisions through their home search journey.

Would you like to see market stats comparing average home prices vs mortgage rates? Let us know at info@tophouse.com