Why You Shouldn’t Listen to the Housing Crash Crusaders (at least with regards to Toronto)

July 29, 2022

If you’ve been following the Canadian real estate market, you’ve noticed that the market has recently cooled off. This is partly because mortgage rates have risen very fast, and partly because prices had risen artificially due to low inventory levels caused by Covid-19 lockdowns. Despite the recent market downturn, don’t believe the housing crash crusaders who think this market is crashing for years, never to return, at least when it comes to Toronto specifically. Very few transactions actually took place at these high price points, and while average prices were quite high in February 2022, those were outliers. Most home owners’ cost basis are much lower, and while the higher mortgage rates are hitting home owners’ bank accounts, there are many reasons why this will not lead to a profusion of power of sales/ foreclosures that will cause a large uncontrollable housing market crash.

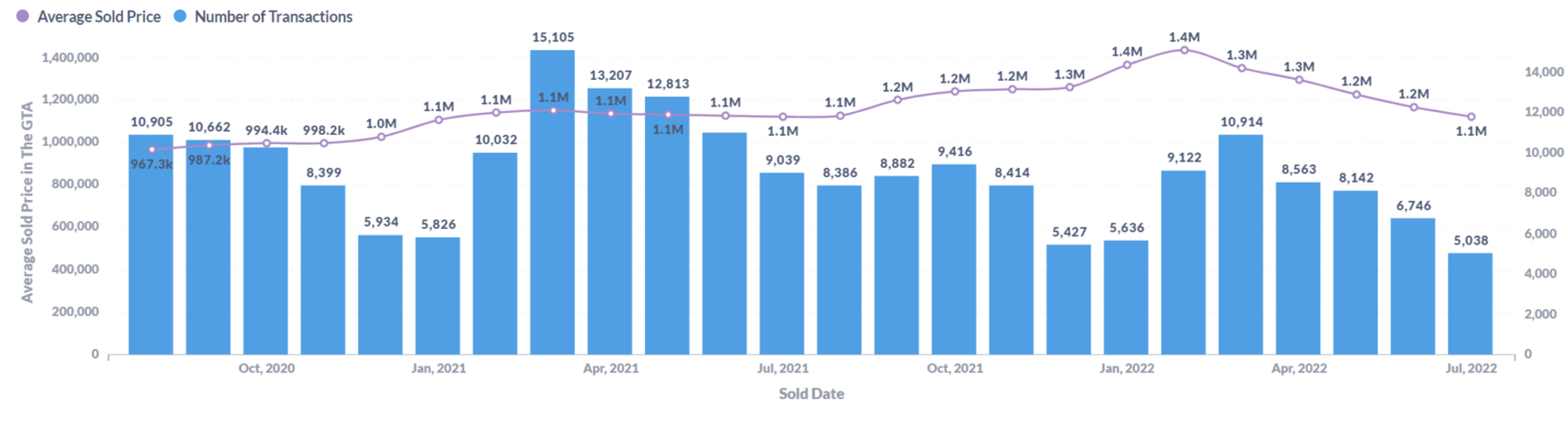

Average Home Prices in the GTA from July 2021 to July 2022 vs. Number of Transactions

*Average sold price of homes across all property types in the GTA have now retreated below August 2021 average sold prices. Source: this data has been compiled from transactions on the TRREB MLS.

Here are a few reasons why betting on house prices to go up in Toronto is a sure bet in the long run (just like it was after 2008, and 2017). The Greater Toronto Area and many of North America’s other major cities will continue to appreciate mainly because of chronic supply shortages, rising construction costs, home buyer demand growth, investor growth, wage growth, and money supply growth. Let’s take a look at each individually.

Chronic supply shortages and high construction costs

The process of bringing on new housing supply is a long and arduous one, often taking 5 to 10 years for large projects. A report by CMHC estimates that we will need 1.85 Million new housing units by 2030 to keep home prices at target affordability. Despite our needs, in 2021 developers were able to deliver 76,000 finished units. If Ontario delivers 100,000 new homes for the next 10 years, we would only be half way to the 1.85 Million goal! We’ve perpetually been in a significant shortfall of new housing. In fact Canada has one of the lowest housing supply per capita out of the G7 countries, with Ontario leading the way of this chronic shortage issue.

We continue to fail to build enough housing because Ontario faces trade labour shortages, high costs of construction, and significant delays in projects due to long approval processes. To make matters worse, the pre-construction housing market is structurally designed never to be oversupplied. Developers must first sell units at price points that they believe are profitable before commencing the project. Occasionally, even If a builder has sold the project already, they often cancel the project and return investors’ deposits if it's no longer profitable for them. Globe and Mail recently covered why Toronto is likely to see a wave of Toronto condo cancellations.

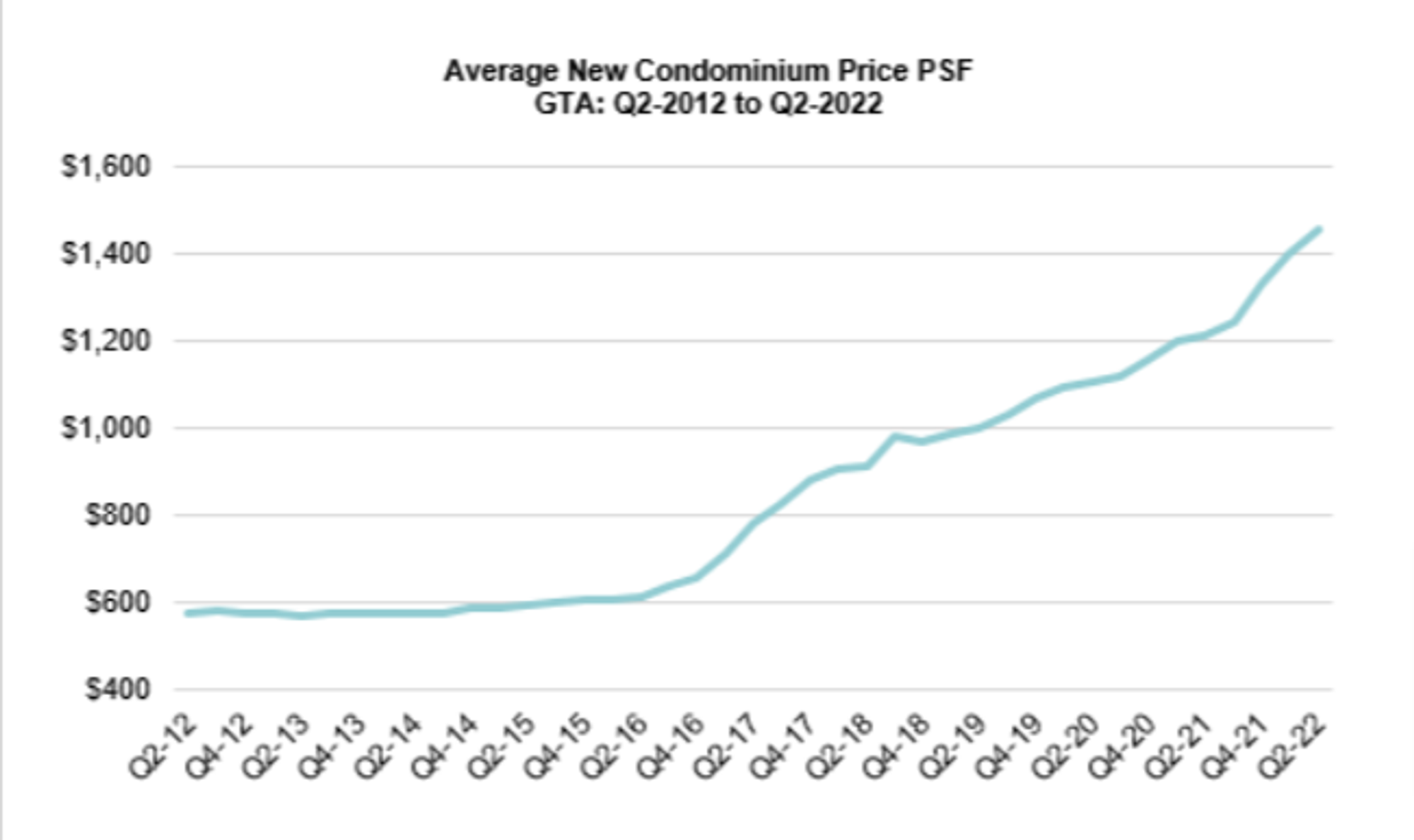

Urbanation reported the average price of a pre-construction unit is at o$1,400/ sqft. Those are the average price points developers calculate they need to sell at to be profitable. A recent report by Toronto Star outlined why developers decided to delay selling 10,000 units that were slated for launch due to low pre-construction sales. These delays in new housing supply is one example of a consistent issue that has perpetuated the chronic shortages. If they can’t get the prices they need for them to be profitable, they will simply wait.

For there to be significant downward price pressures in the market, you need prolonged excessive housing supply. The above factors show why it is unlikely the Greater Toronto Area will see a prolonged over-supply in homes.

Rising costs of construction

With average pre-construction unit prices at $1,400/sqft while resale is at $950/sqft. That 47% gap is the largest gap ever in Toronto’s history. While it’s normal that pre-construction will usually be more expensive than resale, this gap is currently too high and will converge over time. You could see pre-construction prices come down, however, due to high construction costs, it is more likely that new projects will be delayed and not sold at discounts until resale prices catch up and preconstruction buyers are again willing to pay the higher prices.

The rising cost of construction is in part due to trade labour shortages, rising cost of material, and rising cost of land, higher financing costs, and more recently supply chain issues. One major cost that is often overlooked is fees that must be paid to the government. This report estimated that 10% - 23.5% of the cost of a new home are fees paid to the city. Toronto recently proposed to raise development charges another 50%. For example the development charges on a 1 bedroom condo will rise to approximately $50k. This is a cost that developers will pass on to buyers, and those buyers will pass on to future buyers when they are ready to move on, ultimately leading to higher home prices.

In addition, over the years, we’ve seen costs of home ownership continue to increase. In 2008, there was the introduction of the Toronto Land Transfer Tax. And there was also the provincial government’s switch to HST sales tax for new housing. These significant extra costs will ultimately be added to the price of a home and making housing prices higher. To make matters worse, the government seems to be hampering investor demand in pre-construction by implementing new assignment sale and home flipping tax policies. Less pre-construction investors, means less developer sales, which means less new supply coming on the market in the long run.

Population Growth

Toronto consistently ranks among one of the top cities in the world to live in. GTA brings in over 200,000 new immigrants per year. New family formation and immigration create a growing demand for housing that will continue for generations.

While bears may point to a drop off in home sales as evidence of lack of housing demand, this fall off in sale demand is a short term shock caused by fast changing interest rates. The buyers that may have been pushed out of purchasing a home, or may have delayed their purchase due to fear and uncertainty in the market, are now in the rental market. Precisely at the same time as sales dropped, the rental market caught on fire, with rent prices rising 20% year over year. Rapidly changing interest rates cause the market to need to undergo price discovery, one that is playing out quite quickly. When rent prices catch up to the realities of higher mortgage payments it will soon make sense for many home seekers to consider purchasing a home again.

Investor Growth

As the population grows, so does the capital they have available for investment. With population growth comes investor growth. As long as you can collect rent on a home, there will always be someone willing to buy the asset to collect the rent, whether that capital comes from new immigrants bringing new money into Canada or existing residents saving money over time.

Wage Growth

The GTA has a diverse set of high-paying employers in tech, finance, manufacturing, and services. There is also a great education system to provide a high supply of high quality labour, and an overall stable political system, government support, and opportunity for diverse groups of people. You know what’s better than sunshine and the beach for housing demand? Stability and wage growth.

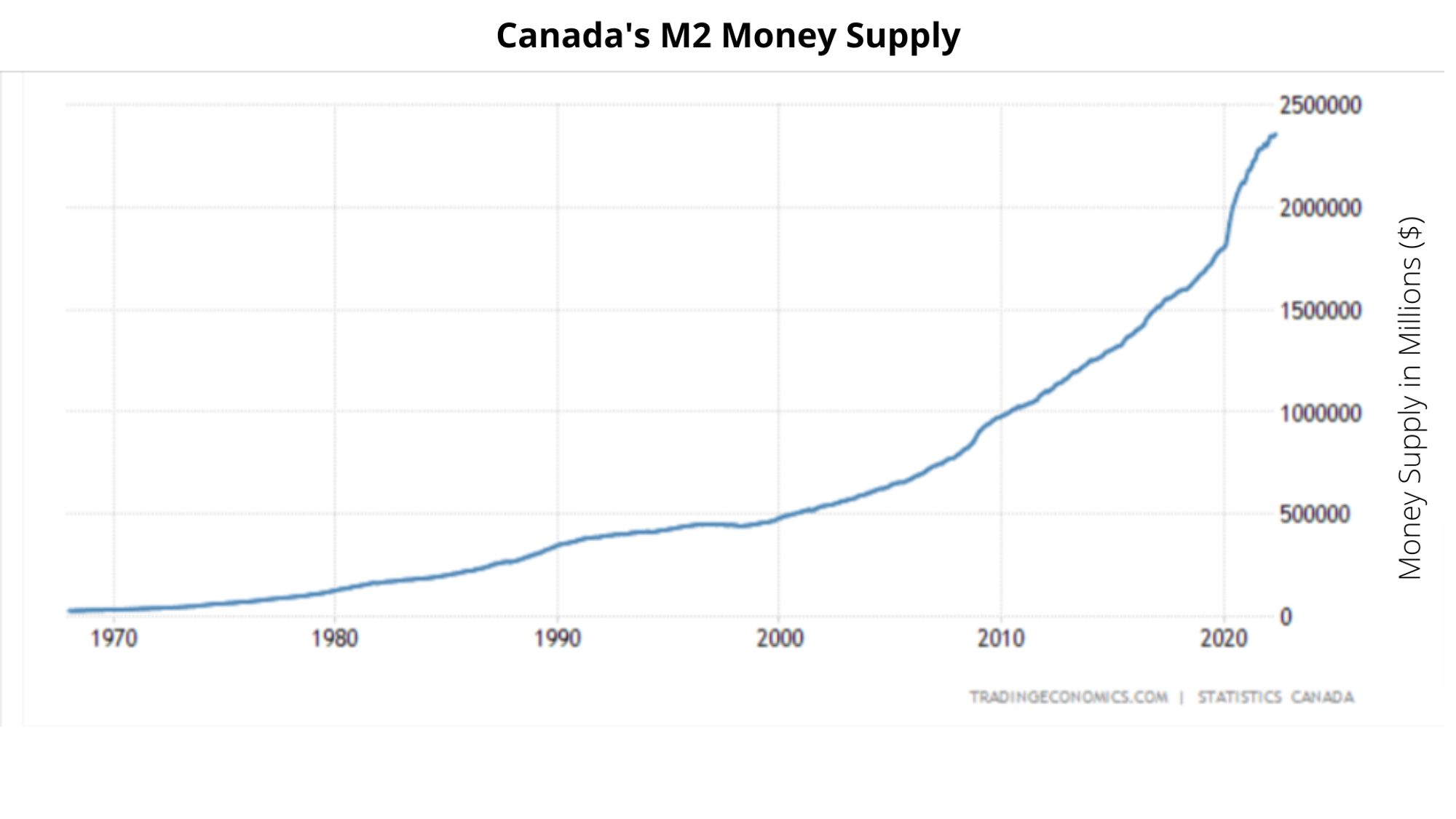

Expansion of Money Supply

Even if none of the above were major factors in determining house prices, our system is designed to print money to create stable but appreciating asset prices. Here is a chart of the amount of money in circulation for the last 50 years in Canada. Printing money is inherent in the structural design of most banking systems. Money by itself has no inherent value and is easy to create, while new housing, as explained above, is one of the hardest assets to create more of. It’s inherent difficulty to bring on new supply, plus the fact that it is one of the most fundamental human needs, makes it one of the most valuable assets to hold on to. So long as that holds true, nominal home prices will increase in the long run, and how much more in the top cities in the world to live in like Toronto.

Source: https://tradingeconomics.com/

Other factors to consider

The mortgage stress test implemented in 2017 anticipated the current rising rate environment and forced buyers to be able to afford higher rates automatically. This in turn provides resilience in the market and ultimately reduces the likelihood of large numbers of foreclosures/power of sales that would cause a significant price drop.

The USA housing crash in 2008 on a national level took 5 years to recover to previous home prices. Many point to this as a reason for a prolonged housing slump in Canada. The housing slump in USA’s major cities like New York, LA, or San Francisco, did not take that long to recover from the crash. While some parts of Canada may experience a longer slump due to rising rates, it is unlikely to be experienced by its most high demand cities like Toronto.

Conclusion

If you live in Toronto, we hope we have laid out convincing reasons why you should not be swayed by the housing crash crusaders. GTA has been an incredibly privileged place to build and preserve your wealth and will likely continue to be in the future. Doom and gloom headlines often attract more attention, but often have their basis in short term price movements, while ignoring the more important overarching trends. This article shows that interest rates are not the only variable that drive home prices in a market. For most people saving for a down payment, purchasing a home, and holding on to that home for a long time will continue to be the best method for building and securing their financial future.

About TopHouse

TopHouse is one of the fastest growing Home Search Apps with with a focus on speed and user friendliness, including short video walkthroughs that make homes easy to browse. We are constantly improving our platform to help home buyers and sellers make better decisions through their home search journey.